Insights for Bank of Canada on NetZero, ESG-SEC, IFRS Agricultural Collapse and Famine

July 7th 2022

Article by FOSADMIN published June 22, 2022, by Friends of Science Society

A pdf of this letter with footnotes and references can be found at the bottom of this post.

June 22, 2022

Open Letter to the Bank of Canada, Office of the Superintendent of Financial Institutions, Parliamentary Budget Officer, Canadian Association of Journalists, News Media Canada, Canadian Federation of Taxpayers, Canadian Coalition of Concerned Manufacturers and Businesses, Canadian Chamber of Commerce

ATTN: Tiff Macklem

RE: Response to June 9th Financial System Review (FSR), Full-scale Laboratory Experiment on Net Zero and Decarbonization – A Reality Check; Concerns about Int’l Financial Reporting Standards, ESG Scope 1-2-3 Compliance, Agricultural Collapse and Famine

We have sent several open letters presenting the case that Net Zero is not attainable and that present climate targets are destructive to the Canadian economy and to most Canadian citizens, companies and organizations that are not privy to the climate gravy train of green government subsidies.

We are aware that banks and the NFGS have been doing their own modeling, attempting to read future climate risks, future risks that the UN Climate Panel (IPCC) has said, as early as 2001, cannot be foretold or projected based on models.

Bank of Canada has written us a letter in which they say: “The Bank of Canada Act instructs the Bank “to promote the economic and financial welfare of Canada.”To carry this out, we need to understand the major forces on our economy. Climate change and the transition to low-carbon growth will have profound impacts on virtually every sector of the economy in the decades ahead. So, to fulfill our monetary policy and financial stability remits, we need to understand the implications of climate change for economic growth and inflation and ensure that Canada’s financial system remains resilient in the years to come.”

We believe the Bank of Canada is not in compliance with the Bank of Canada Act.

On the issue of the attainability of Net Zero, evidence-based analysis is available and preferable to models, many of which are faulty.i Clearly, following a path similar to that described below by Dr. Pierre Louis Kunsch, physicist, would be catastrophic for Canada’s economic and financial welfare (version en francais ci dessous). There is no transition to a low-carbon economy underway and the climate targets set by the federal government are not attainable with existing technology. We ask you to act in the interests of the ‘economic and financial welfare of Canada’, to speak up, and to stop this greenwashing climate charade that is impoverishing the people of Canada and pushing them into carbon serfdom.

Full-scale Laboratory Experiment and Implications

A full-scale laboratory experiment on Net Zero exists, with visible and measurable implications.

Decarbonizing electricity in the European Union: A programmed failure demonstrated by the figures

Contributed by Pierre Kunsch Physicist PhD in Sciences, Honorary Professor at Free University of Brussels © 2022

We must stop rambling on about the Green Deal and the carbon neutrality objectives in the European Union (EU) that we are told could be achieved thanks to 100% so-called renewable energies, by massive electrification of the whole of the energy consumption [1]. The symbols of this transition are wind turbines and photovoltaic panels, variable energy sources, depending on the weather conditions.

A full-scale laboratory has existed for about twenty years. It allows you to form an unbiased opinion of what is possible and what is not. All data for electricity in the EU can be downloaded [2] and is presented in summary below.

First observation: electricity consumption increased by 9% between 2000 and 2021. If there had been a massive electrification of other energy consumption sectors for decarbonization, i.e., around 80% of the final energy consumed excluding electricity, we should have seen much more growth.

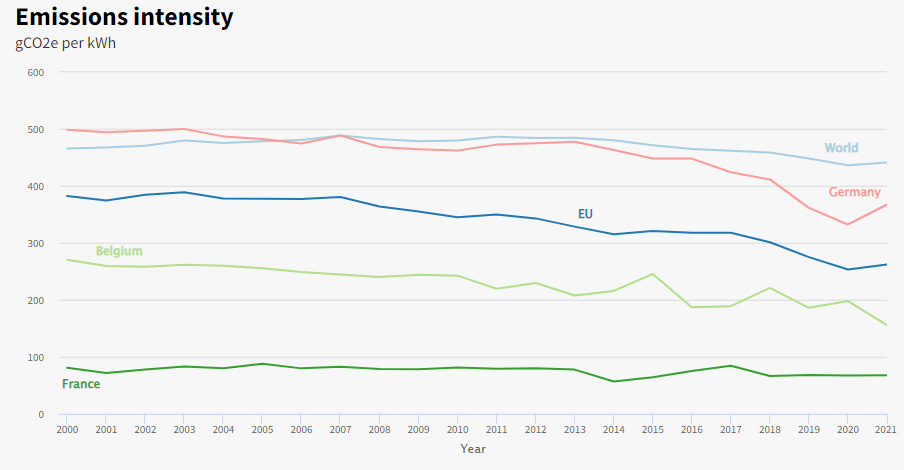

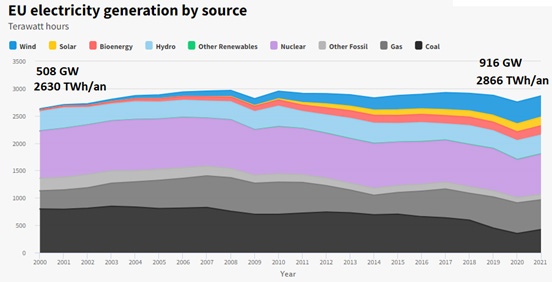

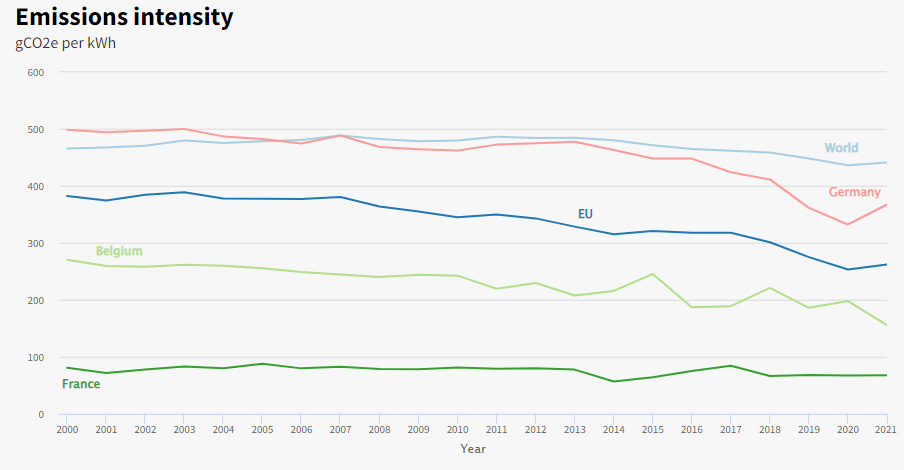

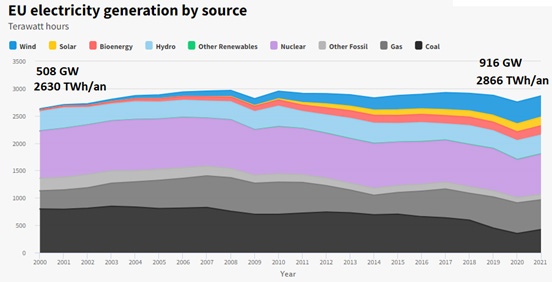

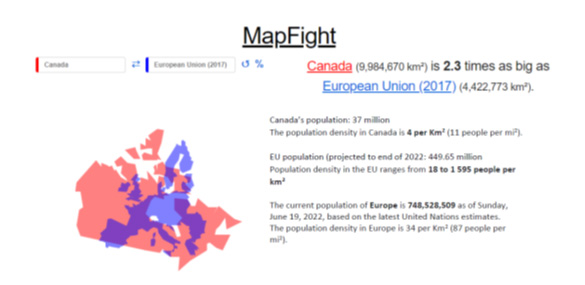

Second observation: wind and photovoltaic capacities, expressed in Gigawatts, i.e. in millions of kW, negligible in 2000, rose to 347.3 GW in 2021 (+2.678%). Meanwhile, traditional dispatchable capacities (natural gas, coal, nuclear, run-of-river hydro and biomass) have not decreased, but on the contrary increased, going from 493 GW to 563 GW (+14%). There was a sharp rise in natural gas (+230%) and a moderate rise in hydropower (+12%), offsetting the sharp reduction in coal capacities (-33%), a strong emitter of CO2, but also nuclear ( -21%), yet non-CO2 emitter. Total capacity has increased from 508 GW in 2000 to 916 GW in 2021, an increase of 80% to satisfy only 9% more consumption! The lion’s share is represented by variable renewables with 39% of this capacity. There was therefore no replacement of dispatchable sources by these so-called ‘clean’ renewables, and therefore no energy transition for electricity which would have led to the gradual disappearance of fossil sources. We do not see how and when this could change. There is no ill will here, but the simple observation that unpredictable sources of wind and sun production alone cannot ensure the energy supply. Dispatchable sources are essential and their capacities must imperatively follow the progression of demand – which is proven by the growth figures for electricity demand in the EU.

Third observation: As for the production of electrical energy in Terawatt-hours per year (TWh/year), i.e. in billions of kWh/year, the figures show the low contribution of wind and solar power, i.e. 19% with 547 TWh/year out of 2,866 TWh/year, compared to the 38% of capacity they represent. By comparison, nuclear contributes 26% to production for 11% of capacity. Renouncing nuclear power would therefore mean depriving oneself of a quarter of the electricity produced in the EU. Replacing renewables to produce the same energy would theoretically mean adding 134% more renewable capacity, to reach 810 GW of wind and solar, which would be unmanageable for the stability of the networks. Even if it were possible, the EU could not afford to give up its dispatchable capacities fueled by natural gas, or even coal.

Fourth observation: the reduction in CO2 emissions of -31% since 2000 remains modest. The Covid crisis with a significant reduction in economic activity alone led to a reduction of -8% between 2019 and 2020, followed however by a rise of +3.5% in 2021. Crises would therefore be effective means to reduce emissions! The reduction is certainly due to the production of variable renewables, but also largely to the reduction in energy production by coal (-47%) and its replacement by natural gas (+63%) whose emissions are lower by about half. The reduction of emissions thanks to the massive installation of wind power and photovoltaic is therefore entirely theoretical, and in any case insufficient with regard to the decarbonization hopes of the Green Deal for all forms of energy.

In conclusion, wind and solar will not be able to fully decarbonize energy in the EU. They will not replace fossil and/or nuclear. Their increased presence on the networks will continue to drive capacity out of control, posing serious stability issues. This unbridled growth will increasingly degrade the performance of dispatchable sources that have remained essential, calling for more pollution [3], and also requiring more financial support, such as Capacity Remuneration Mechanism, to restore their profitability. The message ‘We are on the way to 100% decarbonizing” is clearly false advertising, welcomed by all those who benefit from it. Among these, we find both wind and solar developers as well as gas developers – often within the same companies – and transport networks that are clearly winners in the multiplication of exchanges by networks of the many distributed renewable sources [4].

Pierre Kunsch Physicist, Dr. in Sciences and Honorary Professor of the ULB – Université libre de Bruxelles

References (active links)

[1] The carbon footprint and the Green Deal https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/climate-action-and-green-deal_en

[2] Embers’ electricity data https://ember-climate.org/data/data-explorer/

[3] https://depausa.org/duke-energy-application-points-finger-at-solar-for-increased-pollution/

[4] The transport operators building networks and promoting decarbonizing of society

Source: Pierre Kunsch Opinion Trends-Tendances Le Vif 12th June 2022 https://trends.levif.be/economie/politique-economique/decarboner-l-electricite-dans-l-union-europeenne-un-bilan-chiffre-annonciateur-d-echec/article-opinion-1565905.html

Financial System Review (FSR)

In recent correspondence from the Bank of Canada, we were directed to read the Bank’s June 9th Financial System Review (FSR). We have done so.

The review states:

The war [Ukraine-Russia conflict] has also further added to the level of uncertainty around the transition to a low-carbon economy. In the short term, it threatens global energy security, increasing the dependence on higher emitting fossil fuels like coal, and risks slowing the transition. Over the medium term, transition uncertainty means that assets exposed to the fossil-fuel sector, including those found in the pensions and retirement savings of many Canadians, are at risk of large and rapid repricing. We need better transparency about climate exposures by businesses and financial institutions. We also need clear transition plans by global policymakers. Together these can help mitigate the risk of a disorderly and painful transition that hurts both our financial system and our economy.

As shown in the full-scale EU lab experiment, the world remains reliant on hydrocarbons. The EU’s colossal climate policy blunder has led to the tragic situation in which the EU is now financing Russia’s incursion to the Ukraine to the tune of €70 million per day.

As Samuel Furfari, geopolitical expert and former senior official with the EU for 36 years, has pointed out in “Who is Responsible for Inflation, Russia or the EU?” regarding inflation and the energy crisis, “Besides the high demand (for oil), there is a more pernicious reason: the lack of investment in an industry that has always operated in continuous flow. Unlike, for example, a Tesla mega-factory or a nuclear power plant, the production of hydrocarbons requires continuous investment in prospecting and exploration.”

Canada is rich in these resources, and once had a toehold in the EU, planning to build Canadian pipelines from the oil sands to enhance supply and access to global markets, yet in your financial system review, and indeed nowhere on your website do we find any reference to the Tar Sands Campaign green trade war that has decimated our economy and made thousands of people jobless. It has intentionally driven off the long-term investment and various Tar Sands Campaign actors have destroyed the once stable and globally respected National Energy Board (NEB), turning it into a subjective assessment process (Bill C-69), subject to personal whims of cabinet, a process repugnant to investors in long-term assets and infrastructure. Canada has been described by PPHB Energy Bankers of Houston as being “hostile” to investment. Consequently, we wonder why this is not the Number 1 concern of the Bank of Canada, the Office of the Superintendent of Financial Institutions (OSFI), and the Big Five commercial banks?

Indeed, we wonder if the OSFI has been doing its job: “The Office of the Superintendent of Financial Institutions (OSFI) is an independent federal government agency that regulates and supervises more than 400 federally regulated financial institutions and 1,200 pension plans to determine whether they are in sound financial condition and meeting their requirements.”

It is astonishing that the Bank of Canada and OSFI does not seem to have noticed the Tar Sands Campaign multi-billion-dollar surreptitious destruction of the Canadian economy. The campaign is not hidden; every bank has been attacked for lending to oil, gas, oilsands, and coal operations. In fact, West Coast Environmental Law (WCEL) has just launched a new campaign to “Sue Big Oil” – an ENGO ‘charity’ based in a province wherein Vancouver Port, Nanaimo Port, BC Ferries and YVR, are the drivers of a large segment of Canada’s economy and most of the BC economy, all reliant 100% on “Big Oil” for their existence.

Obviously the “Sue Big Oil” campaign by the foreign and domestic funded WCEL poses a serious economic and reputational risk to Canada. What are you going to do about it? This is just a continuation of the 20-year Tar Sands Campaign, so although this particular attack is new and would not have been reflected in your June 9th commentary, we find nothing about the economic risks of the Tar Sands Campaign in Bank of Canada documents.

The Allan Inquiry/Alberta Inquiry reports were issued to the public on Oct. 21, 2021, yet the Bank of Canada apparently does not see the Tar Sands Campaign as ‘affecting the economic and financial welfare of Canada.’

The Deloitte forensic audit found billions of dollars of foreign-funding pouring into Canada via Environmental Nongovernmental Organizations (ENGOs), many of which are ‘charities’, the tax-subsidies for which drain Canada’s tax-pool, yet the Bank of Canada (and Canadian commercial banks which were so quick to freeze the accounts of some participants and funders of the Freedom Convoy on Mark Carney’s unproven allegations of ‘sedition’ ), has literally nothing to say about this economically destructive, foreign-funded campaign.

The Inquiry’s findings were in fact significant. The adversaries of oil sands development, and the financial and insurance companies that backed them, claim to have brought about more than 1,000 divestments representing $8 trillion.

Governor Macklem, in your FSR you write:

In nearly every FSR, we warn about the high debt that many Canadian households are carrying, and we warn about elevated house prices. Those are not new vulnerabilities, but the pandemic has affected them.

You comment on household debt, but do not address the monumental financial challenges facing Canada and Canadian taxpayers due to the reckless pandemic spending. The Department of Finance Fiscal Tables shows that:

“Federal expenditures, excluding interest payments on the debt, rose from $314.5 billion in 2018-2019 to $608.5 billion in 2020-2021. In other words, expenditures rose by 93% in two years, the largest increase in history.”

“The federal government budgetary deficit rose from $5.6 billion in 2018-2019 to $312.4 billion in 2020-2021, an increase of 5479%.”

Are you sure household debt is the biggest problem we have, real as it is?

The pandemic and the conflict between Russia and the Ukraine have shown that the world runs on hydrocarbons and there is a huge, un-ending market for them globally.

federal, provincial, and municipal governments are funding the already tax subsidized charitable ENGO sector with billions of dollars in grants and additional subsidies of taxpayer dollars every year. Our calculations show this sum is in the order of $5,000 a year for every man, woman, and child in Canada, meaning a family of four has been stripped of $20,000. of tax-funded services (i.e., health care, military, etc.) by governments pandering to ENGOs and other charities. If these practises stopped, most Canadians would de-risk their debt status, indeed, why not just rebate these dollars directly to Canadians and stop the greenwashing folly of the carbon rebate? When will you address this issue?r>

If the Tar Sands Campaign was stopped, or even publicly challenged by the Bank of Canada and the banking sector, if those ENGO ‘charitable’ accounts and assets were frozen and de-banked, ENGOs that have received millions and billions from foreign donors with agendas, that have done so much damage to Canada; if they were de-banked as efficiently and immediately as you and your commercial banking associates de-banked the hapless individuals who donated $20-100s of dollars of their personal funds supporting the legal protest of the Freedom Convoy, Canada would be in a different and positive economic place.

In the Bank of Canada June 9th, 2022, FSR, there is absolutely no reference to the impending International Financial Reporting Standards (IFRS) which will further negatively impact Canada’s resource sector.

As strategic energy analyst, Dr. Tammy Nemeth, explains in her recent report “Counting Carbon Molecules:”

“Once the IFRS Sustainability Disclosure Standard is enforceable, the finances and operations of hydrocarbon companies, and any industry that utilizes hydrocarbons, will be seriously compromised to the point of extinction.”

Hopefully the Bank of Canada is aware that EVERY INDUSTRY utilizes hydrocarbons.

Dr. Nemeth has published a summary of her report in the Financial Post, noting that comments are open until July 29th. We look forward to the Bank of Canada issuing a report on the risk to Canada if the country were to sign on to the IFRS.

US market analyst Steve Soukup notes that the ESG disclosure requirements the SEC is presently fielding would broaden inflation and lead to massive food price rise and potential collapse of vital agriculture.

“For farmers to stay compliant with the companies that purchase their products downstream, this could mean producers will need to track and disclose on-farm data regarding individual operations and day-to-day activities. Unlike large corporations currently regulated by the SEC, farmers do not have teams of compliance officers or attorneys dedicated to handling SEC compliance issues. This could force farmers of all sizes, but particularly those with small and medium-sized operations, to report data they may be unable to provide, which would result in a costly additional expense or a loss of business to larger farms.”

“Add to this the fact that many farmers with methane-heavy operations (i.e., cattle farms) have already been warned that their “climate impact” will likely mean reduced opportunity for/likelihood of debt financing, and you have a recipe for massive food cost increases, production shortages, and Gaia knows what else.”

Soukup’s article “The Broadening Drivers of Inflation” refers to a Richard Morrison analysis entitled “The SEC’s Costly Power Grab” published June 2, 2022 by the Competitive Enterprise Institute. In it, Morrison states “The SEC’s own estimates suggest that the overall cost of disclosure and compliance for public companies will rise from approximately $3.8 billion per year to over $10.2 billion—a more than 250 percent increase, based on this rule alone.”

There is significant evidence that those pushing ESG reporting standards that are crippling industries and investment are funded by parties with pecuniary interests who are using ENGO legal battles against oil and gas and governments as proxies, so that they can capitalize on the spoils of the Green Trade Wars they launch, whether the ESG racket, carbon trading, vulture investing, or skimming venture capital and government funding on “NetZero solutions” start-ups.

Likewise, several reports indicate that Russia has funded ENGOs to push for green policies that result in disembowelling the critical energy infrastructure of conventional power that is reliable, affordable and dispatchable (on demand). Russia has consistently rejected Kyoto/Paris climate agreements and carbon pricing. Russia sees these climate agreements as destructive to human civilization. Is Canada being suckered into committing energy harikari?

Much evidence exists that green billionaires and philanthropies have capitalized on ENGO activity to push for Enron-style market manipulation, carbon markets which deal in the ‘lack of delivery of an invisible substance to no one’, and a price on carbon, to the detriment of citizens and Western Nations.

We find no reference to these economic and financial risks to Canada on your websites. Are you compliant with your relevant Acts? It doesn’t look like it.

In closing, we ask you to get a firm grip on reality. As noted in previous documents and letters to you, the alleged climate emergency is over, as the UN Climate Panel (IPCC) no longer sees the implausible RCP8.5 as our likely future. Roger Pielke, Jr. offers a plain language overview of this issue, and this peer-reviewed paper, in case you missed it.

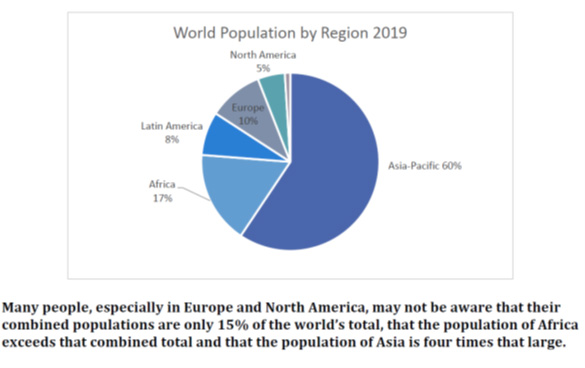

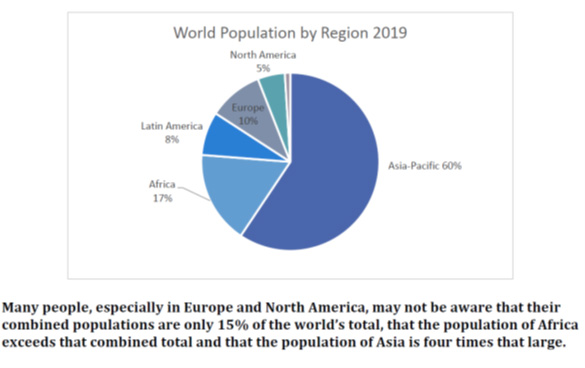

None of the emerging nations will be playing the climate game as the West does not have $750 billion a year in ‘loss and damage’ reparations demanded by these nations to assuage alleged climate guilt and to agree to play ball on the Paris Agreement. Thus, despite Mark Carney’s threats to strand assets of companies that won’t play the global climate game, the only assets stranded will be the resources RICHES that gullible Canadians strand themselves. Global oil, gas and coal markets are booming while we shoot ourselves in the foot, and the Bank of Canada worries about household debt! Meanwhile USD $21 trillion in Canadian/Albertan resource wealth is subject to a foreign-funded green trade war and Blockadia and the Bank of Canada expresses no concern. The net revenues from these resources would likely be around $13 Trillion Cdn. And with that we could solve many problems in Canada or the world:

How much is Cdn $13 trillion?

In light of this evidence, it is difficult to see how the Bank of Canada or OFSI are acting “to promote the economic and financial welfare of Canada.”

Perhaps we are simply not aware of your work on the impact of the Tar Sands Campaign on the economic and financial welfare of Canada. Please provide any studies or reports showing your efforts to protect Canadians from this multi-billion-dollar foreign funded threat.

Sincerely,

Ron Davison, P. Eng.

President

Friends of Science Society

Endnote:

Models are necessary when there are many variables and calculations required. The problem is not with using models, the problem is using faulty models. Models need to be based on data and good evidence-based analysis. A paper on the NFGS website says they use three integrated assessment models (IAM), but they seem very different from the IAMs governments use to determine social costs of carbon. However, they must calculate some social costs.

Most models of the economic impacts of climate change are wrong because:

The FUND model in particular falsely forecast a 3 °C warming would increase USA space heating + cooling costs by $121 billion but EIA data analysis shows it would reduce costs by $10 billion. Warm periods of Earth’s history and warm regions of our current world have greater abundance of wildlife and species diversity than cooler periods and regions. Recent studies show that warming reduces cold-related deaths by 10 to 17 times more than it increases heat-related deaths, but the models show increasing deaths due to climate change.

The FUND model calculates that the benefits of CO2 emissions on agriculture is 95 times the harmful costs of sea level rise and severe storms combined when the temperature forecast is based on evidence-based analysis.

Open-Letter-to-Bank-of-Canada-on-Net-Zero-EU-experiment

Original article link found here:

https://blog.friendsofscience.org/2022/06/22/insights-for-bank-of-canada-on-netzero-esg-sec-ifrs-agricultural-collapse-and-famine/

A pdf of this letter with footnotes and references can be found at the bottom of this post.

June 22, 2022

Open Letter to the Bank of Canada, Office of the Superintendent of Financial Institutions, Parliamentary Budget Officer, Canadian Association of Journalists, News Media Canada, Canadian Federation of Taxpayers, Canadian Coalition of Concerned Manufacturers and Businesses, Canadian Chamber of Commerce

ATTN: Tiff Macklem

RE: Response to June 9th Financial System Review (FSR), Full-scale Laboratory Experiment on Net Zero and Decarbonization – A Reality Check; Concerns about Int’l Financial Reporting Standards, ESG Scope 1-2-3 Compliance, Agricultural Collapse and Famine

We have sent several open letters presenting the case that Net Zero is not attainable and that present climate targets are destructive to the Canadian economy and to most Canadian citizens, companies and organizations that are not privy to the climate gravy train of green government subsidies.

We are aware that banks and the NFGS have been doing their own modeling, attempting to read future climate risks, future risks that the UN Climate Panel (IPCC) has said, as early as 2001, cannot be foretold or projected based on models.

Bank of Canada has written us a letter in which they say: “The Bank of Canada Act instructs the Bank “to promote the economic and financial welfare of Canada.”To carry this out, we need to understand the major forces on our economy. Climate change and the transition to low-carbon growth will have profound impacts on virtually every sector of the economy in the decades ahead. So, to fulfill our monetary policy and financial stability remits, we need to understand the implications of climate change for economic growth and inflation and ensure that Canada’s financial system remains resilient in the years to come.”

We believe the Bank of Canada is not in compliance with the Bank of Canada Act.

On the issue of the attainability of Net Zero, evidence-based analysis is available and preferable to models, many of which are faulty.i Clearly, following a path similar to that described below by Dr. Pierre Louis Kunsch, physicist, would be catastrophic for Canada’s economic and financial welfare (version en francais ci dessous). There is no transition to a low-carbon economy underway and the climate targets set by the federal government are not attainable with existing technology. We ask you to act in the interests of the ‘economic and financial welfare of Canada’, to speak up, and to stop this greenwashing climate charade that is impoverishing the people of Canada and pushing them into carbon serfdom.

Full-scale Laboratory Experiment and Implications

A full-scale laboratory experiment on Net Zero exists, with visible and measurable implications.

Decarbonizing electricity in the European Union: A programmed failure demonstrated by the figures

Contributed by Pierre Kunsch Physicist PhD in Sciences, Honorary Professor at Free University of Brussels © 2022

We must stop rambling on about the Green Deal and the carbon neutrality objectives in the European Union (EU) that we are told could be achieved thanks to 100% so-called renewable energies, by massive electrification of the whole of the energy consumption [1]. The symbols of this transition are wind turbines and photovoltaic panels, variable energy sources, depending on the weather conditions.

A full-scale laboratory has existed for about twenty years. It allows you to form an unbiased opinion of what is possible and what is not. All data for electricity in the EU can be downloaded [2] and is presented in summary below.

First observation: electricity consumption increased by 9% between 2000 and 2021. If there had been a massive electrification of other energy consumption sectors for decarbonization, i.e., around 80% of the final energy consumed excluding electricity, we should have seen much more growth.

Second observation: wind and photovoltaic capacities, expressed in Gigawatts, i.e. in millions of kW, negligible in 2000, rose to 347.3 GW in 2021 (+2.678%). Meanwhile, traditional dispatchable capacities (natural gas, coal, nuclear, run-of-river hydro and biomass) have not decreased, but on the contrary increased, going from 493 GW to 563 GW (+14%). There was a sharp rise in natural gas (+230%) and a moderate rise in hydropower (+12%), offsetting the sharp reduction in coal capacities (-33%), a strong emitter of CO2, but also nuclear ( -21%), yet non-CO2 emitter. Total capacity has increased from 508 GW in 2000 to 916 GW in 2021, an increase of 80% to satisfy only 9% more consumption! The lion’s share is represented by variable renewables with 39% of this capacity. There was therefore no replacement of dispatchable sources by these so-called ‘clean’ renewables, and therefore no energy transition for electricity which would have led to the gradual disappearance of fossil sources. We do not see how and when this could change. There is no ill will here, but the simple observation that unpredictable sources of wind and sun production alone cannot ensure the energy supply. Dispatchable sources are essential and their capacities must imperatively follow the progression of demand – which is proven by the growth figures for electricity demand in the EU.

Third observation: As for the production of electrical energy in Terawatt-hours per year (TWh/year), i.e. in billions of kWh/year, the figures show the low contribution of wind and solar power, i.e. 19% with 547 TWh/year out of 2,866 TWh/year, compared to the 38% of capacity they represent. By comparison, nuclear contributes 26% to production for 11% of capacity. Renouncing nuclear power would therefore mean depriving oneself of a quarter of the electricity produced in the EU. Replacing renewables to produce the same energy would theoretically mean adding 134% more renewable capacity, to reach 810 GW of wind and solar, which would be unmanageable for the stability of the networks. Even if it were possible, the EU could not afford to give up its dispatchable capacities fueled by natural gas, or even coal.

Fourth observation: the reduction in CO2 emissions of -31% since 2000 remains modest. The Covid crisis with a significant reduction in economic activity alone led to a reduction of -8% between 2019 and 2020, followed however by a rise of +3.5% in 2021. Crises would therefore be effective means to reduce emissions! The reduction is certainly due to the production of variable renewables, but also largely to the reduction in energy production by coal (-47%) and its replacement by natural gas (+63%) whose emissions are lower by about half. The reduction of emissions thanks to the massive installation of wind power and photovoltaic is therefore entirely theoretical, and in any case insufficient with regard to the decarbonization hopes of the Green Deal for all forms of energy.

In conclusion, wind and solar will not be able to fully decarbonize energy in the EU. They will not replace fossil and/or nuclear. Their increased presence on the networks will continue to drive capacity out of control, posing serious stability issues. This unbridled growth will increasingly degrade the performance of dispatchable sources that have remained essential, calling for more pollution [3], and also requiring more financial support, such as Capacity Remuneration Mechanism, to restore their profitability. The message ‘We are on the way to 100% decarbonizing” is clearly false advertising, welcomed by all those who benefit from it. Among these, we find both wind and solar developers as well as gas developers – often within the same companies – and transport networks that are clearly winners in the multiplication of exchanges by networks of the many distributed renewable sources [4].

Pierre Kunsch Physicist, Dr. in Sciences and Honorary Professor of the ULB – Université libre de Bruxelles

References (active links)

[1] The carbon footprint and the Green Deal https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/climate-action-and-green-deal_en

[2] Embers’ electricity data https://ember-climate.org/data/data-explorer/

[3] https://depausa.org/duke-energy-application-points-finger-at-solar-for-increased-pollution/

[4] The transport operators building networks and promoting decarbonizing of society

Source: Pierre Kunsch Opinion Trends-Tendances Le Vif 12th June 2022 https://trends.levif.be/economie/politique-economique/decarboner-l-electricite-dans-l-union-europeenne-un-bilan-chiffre-annonciateur-d-echec/article-opinion-1565905.html

Financial System Review (FSR)

In recent correspondence from the Bank of Canada, we were directed to read the Bank’s June 9th Financial System Review (FSR). We have done so.

The review states:

The war [Ukraine-Russia conflict] has also further added to the level of uncertainty around the transition to a low-carbon economy. In the short term, it threatens global energy security, increasing the dependence on higher emitting fossil fuels like coal, and risks slowing the transition. Over the medium term, transition uncertainty means that assets exposed to the fossil-fuel sector, including those found in the pensions and retirement savings of many Canadians, are at risk of large and rapid repricing. We need better transparency about climate exposures by businesses and financial institutions. We also need clear transition plans by global policymakers. Together these can help mitigate the risk of a disorderly and painful transition that hurts both our financial system and our economy.

As shown in the full-scale EU lab experiment, the world remains reliant on hydrocarbons. The EU’s colossal climate policy blunder has led to the tragic situation in which the EU is now financing Russia’s incursion to the Ukraine to the tune of €70 million per day.

As Samuel Furfari, geopolitical expert and former senior official with the EU for 36 years, has pointed out in “Who is Responsible for Inflation, Russia or the EU?” regarding inflation and the energy crisis, “Besides the high demand (for oil), there is a more pernicious reason: the lack of investment in an industry that has always operated in continuous flow. Unlike, for example, a Tesla mega-factory or a nuclear power plant, the production of hydrocarbons requires continuous investment in prospecting and exploration.”

Canada is rich in these resources, and once had a toehold in the EU, planning to build Canadian pipelines from the oil sands to enhance supply and access to global markets, yet in your financial system review, and indeed nowhere on your website do we find any reference to the Tar Sands Campaign green trade war that has decimated our economy and made thousands of people jobless. It has intentionally driven off the long-term investment and various Tar Sands Campaign actors have destroyed the once stable and globally respected National Energy Board (NEB), turning it into a subjective assessment process (Bill C-69), subject to personal whims of cabinet, a process repugnant to investors in long-term assets and infrastructure. Canada has been described by PPHB Energy Bankers of Houston as being “hostile” to investment. Consequently, we wonder why this is not the Number 1 concern of the Bank of Canada, the Office of the Superintendent of Financial Institutions (OSFI), and the Big Five commercial banks?

Indeed, we wonder if the OSFI has been doing its job: “The Office of the Superintendent of Financial Institutions (OSFI) is an independent federal government agency that regulates and supervises more than 400 federally regulated financial institutions and 1,200 pension plans to determine whether they are in sound financial condition and meeting their requirements.”

It is astonishing that the Bank of Canada and OSFI does not seem to have noticed the Tar Sands Campaign multi-billion-dollar surreptitious destruction of the Canadian economy. The campaign is not hidden; every bank has been attacked for lending to oil, gas, oilsands, and coal operations. In fact, West Coast Environmental Law (WCEL) has just launched a new campaign to “Sue Big Oil” – an ENGO ‘charity’ based in a province wherein Vancouver Port, Nanaimo Port, BC Ferries and YVR, are the drivers of a large segment of Canada’s economy and most of the BC economy, all reliant 100% on “Big Oil” for their existence.

Obviously the “Sue Big Oil” campaign by the foreign and domestic funded WCEL poses a serious economic and reputational risk to Canada. What are you going to do about it? This is just a continuation of the 20-year Tar Sands Campaign, so although this particular attack is new and would not have been reflected in your June 9th commentary, we find nothing about the economic risks of the Tar Sands Campaign in Bank of Canada documents.

The Allan Inquiry/Alberta Inquiry reports were issued to the public on Oct. 21, 2021, yet the Bank of Canada apparently does not see the Tar Sands Campaign as ‘affecting the economic and financial welfare of Canada.’

The Deloitte forensic audit found billions of dollars of foreign-funding pouring into Canada via Environmental Nongovernmental Organizations (ENGOs), many of which are ‘charities’, the tax-subsidies for which drain Canada’s tax-pool, yet the Bank of Canada (and Canadian commercial banks which were so quick to freeze the accounts of some participants and funders of the Freedom Convoy on Mark Carney’s unproven allegations of ‘sedition’ ), has literally nothing to say about this economically destructive, foreign-funded campaign.

The Inquiry’s findings were in fact significant. The adversaries of oil sands development, and the financial and insurance companies that backed them, claim to have brought about more than 1,000 divestments representing $8 trillion.

Governor Macklem, in your FSR you write:

In nearly every FSR, we warn about the high debt that many Canadian households are carrying, and we warn about elevated house prices. Those are not new vulnerabilities, but the pandemic has affected them.

You comment on household debt, but do not address the monumental financial challenges facing Canada and Canadian taxpayers due to the reckless pandemic spending. The Department of Finance Fiscal Tables shows that:

“Federal expenditures, excluding interest payments on the debt, rose from $314.5 billion in 2018-2019 to $608.5 billion in 2020-2021. In other words, expenditures rose by 93% in two years, the largest increase in history.”

“The federal government budgetary deficit rose from $5.6 billion in 2018-2019 to $312.4 billion in 2020-2021, an increase of 5479%.”

Are you sure household debt is the biggest problem we have, real as it is?

The pandemic and the conflict between Russia and the Ukraine have shown that the world runs on hydrocarbons and there is a huge, un-ending market for them globally.

If the Tar Sands Campaign was stopped, or even publicly challenged by the Bank of Canada and the banking sector, if those ENGO ‘charitable’ accounts and assets were frozen and de-banked, ENGOs that have received millions and billions from foreign donors with agendas, that have done so much damage to Canada; if they were de-banked as efficiently and immediately as you and your commercial banking associates de-banked the hapless individuals who donated $20-100s of dollars of their personal funds supporting the legal protest of the Freedom Convoy, Canada would be in a different and positive economic place.

In the Bank of Canada June 9th, 2022, FSR, there is absolutely no reference to the impending International Financial Reporting Standards (IFRS) which will further negatively impact Canada’s resource sector.

As strategic energy analyst, Dr. Tammy Nemeth, explains in her recent report “Counting Carbon Molecules:”

“Once the IFRS Sustainability Disclosure Standard is enforceable, the finances and operations of hydrocarbon companies, and any industry that utilizes hydrocarbons, will be seriously compromised to the point of extinction.”

Hopefully the Bank of Canada is aware that EVERY INDUSTRY utilizes hydrocarbons.

Dr. Nemeth has published a summary of her report in the Financial Post, noting that comments are open until July 29th. We look forward to the Bank of Canada issuing a report on the risk to Canada if the country were to sign on to the IFRS.

US market analyst Steve Soukup notes that the ESG disclosure requirements the SEC is presently fielding would broaden inflation and lead to massive food price rise and potential collapse of vital agriculture.

“For farmers to stay compliant with the companies that purchase their products downstream, this could mean producers will need to track and disclose on-farm data regarding individual operations and day-to-day activities. Unlike large corporations currently regulated by the SEC, farmers do not have teams of compliance officers or attorneys dedicated to handling SEC compliance issues. This could force farmers of all sizes, but particularly those with small and medium-sized operations, to report data they may be unable to provide, which would result in a costly additional expense or a loss of business to larger farms.”

“Add to this the fact that many farmers with methane-heavy operations (i.e., cattle farms) have already been warned that their “climate impact” will likely mean reduced opportunity for/likelihood of debt financing, and you have a recipe for massive food cost increases, production shortages, and Gaia knows what else.”

Soukup’s article “The Broadening Drivers of Inflation” refers to a Richard Morrison analysis entitled “The SEC’s Costly Power Grab” published June 2, 2022 by the Competitive Enterprise Institute. In it, Morrison states “The SEC’s own estimates suggest that the overall cost of disclosure and compliance for public companies will rise from approximately $3.8 billion per year to over $10.2 billion—a more than 250 percent increase, based on this rule alone.”

There is significant evidence that those pushing ESG reporting standards that are crippling industries and investment are funded by parties with pecuniary interests who are using ENGO legal battles against oil and gas and governments as proxies, so that they can capitalize on the spoils of the Green Trade Wars they launch, whether the ESG racket, carbon trading, vulture investing, or skimming venture capital and government funding on “NetZero solutions” start-ups.

Likewise, several reports indicate that Russia has funded ENGOs to push for green policies that result in disembowelling the critical energy infrastructure of conventional power that is reliable, affordable and dispatchable (on demand). Russia has consistently rejected Kyoto/Paris climate agreements and carbon pricing. Russia sees these climate agreements as destructive to human civilization. Is Canada being suckered into committing energy harikari?

Much evidence exists that green billionaires and philanthropies have capitalized on ENGO activity to push for Enron-style market manipulation, carbon markets which deal in the ‘lack of delivery of an invisible substance to no one’, and a price on carbon, to the detriment of citizens and Western Nations.

We find no reference to these economic and financial risks to Canada on your websites. Are you compliant with your relevant Acts? It doesn’t look like it.

In closing, we ask you to get a firm grip on reality. As noted in previous documents and letters to you, the alleged climate emergency is over, as the UN Climate Panel (IPCC) no longer sees the implausible RCP8.5 as our likely future. Roger Pielke, Jr. offers a plain language overview of this issue, and this peer-reviewed paper, in case you missed it.

How much is Cdn $13 trillion?

- If you could somehow spend one million dollars a day, it would take over 35,600 years to spend $13 trillion.

- There are about 50,000 hospitals in the OECD countries, each of which probably cost about $250 million. Their total value is thus roughly $12.5 trillion, about the same as the potential present market value of Canada’s fossil fuel resources.

- The distance from the earth to the Sun is 149 million kilometres. If you paid one dollar per kilometre, with $13 trillion you could travel to the Sun and back (i.e. 298 million km) about 43,600 times.

- With $13 trillion, you could pay off Canada’s entire national debt 13 times.

- With $13 trillion, you could give $1,733 to every person on the planet.

- With $13 trillion, you could give every Canadian $342,000.

In light of this evidence, it is difficult to see how the Bank of Canada or OFSI are acting “to promote the economic and financial welfare of Canada.”

Perhaps we are simply not aware of your work on the impact of the Tar Sands Campaign on the economic and financial welfare of Canada. Please provide any studies or reports showing your efforts to protect Canadians from this multi-billion-dollar foreign funded threat.

Sincerely,

Ron Davison, P. Eng.

President

Friends of Science Society

Endnote:

Models are necessary when there are many variables and calculations required. The problem is not with using models, the problem is using faulty models. Models need to be based on data and good evidence-based analysis. A paper on the NFGS website says they use three integrated assessment models (IAM), but they seem very different from the IAMs governments use to determine social costs of carbon. However, they must calculate some social costs.

Most models of the economic impacts of climate change are wrong because:

- For a given greenhouse gas (GHG) emissions forecast and climate sensitivity, the economic models produce too high temperature forecasts compared to climate models.

- Climate models are running too hot by a factor of about two. Economic models that are tuned to climate models assume too high climate sensitivity and therefore too rapid increase in forecast temperatures.

- The PAGE and DICE economic models fail to include the benefits of warming and CO2 fertilization. The FUND model includes too little CO2 fertilization effect. Economic models of the social cost of carbon dioxide should include benefits, not just costs.

- Most models fail to include the huge benefits of adaptation expenditures such as building defenses against flooding. This failure grossly inflates the calculated social costs of emissions.

- Most models use highly improbable and too high emissions scenarios.

- Most models assume large damages due to water scarcity, but the data shows warming will increase rainfall and reduce water scarcity.

- Most models assume the most harmful forecast of other impact sectors such as energy use, ecosystems and health that do not agree with the best evidence.

The FUND model in particular falsely forecast a 3 °C warming would increase USA space heating + cooling costs by $121 billion but EIA data analysis shows it would reduce costs by $10 billion. Warm periods of Earth’s history and warm regions of our current world have greater abundance of wildlife and species diversity than cooler periods and regions. Recent studies show that warming reduces cold-related deaths by 10 to 17 times more than it increases heat-related deaths, but the models show increasing deaths due to climate change.

The FUND model calculates that the benefits of CO2 emissions on agriculture is 95 times the harmful costs of sea level rise and severe storms combined when the temperature forecast is based on evidence-based analysis.

Open-Letter-to-Bank-of-Canada-on-Net-Zero-EU-experiment

Original article link found here:

https://blog.friendsofscience.org/2022/06/22/insights-for-bank-of-canada-on-netzero-esg-sec-ifrs-agricultural-collapse-and-famine/

Click to close